Intellectual property (IP)

Securing the UK’s ambition to be a life science superpower

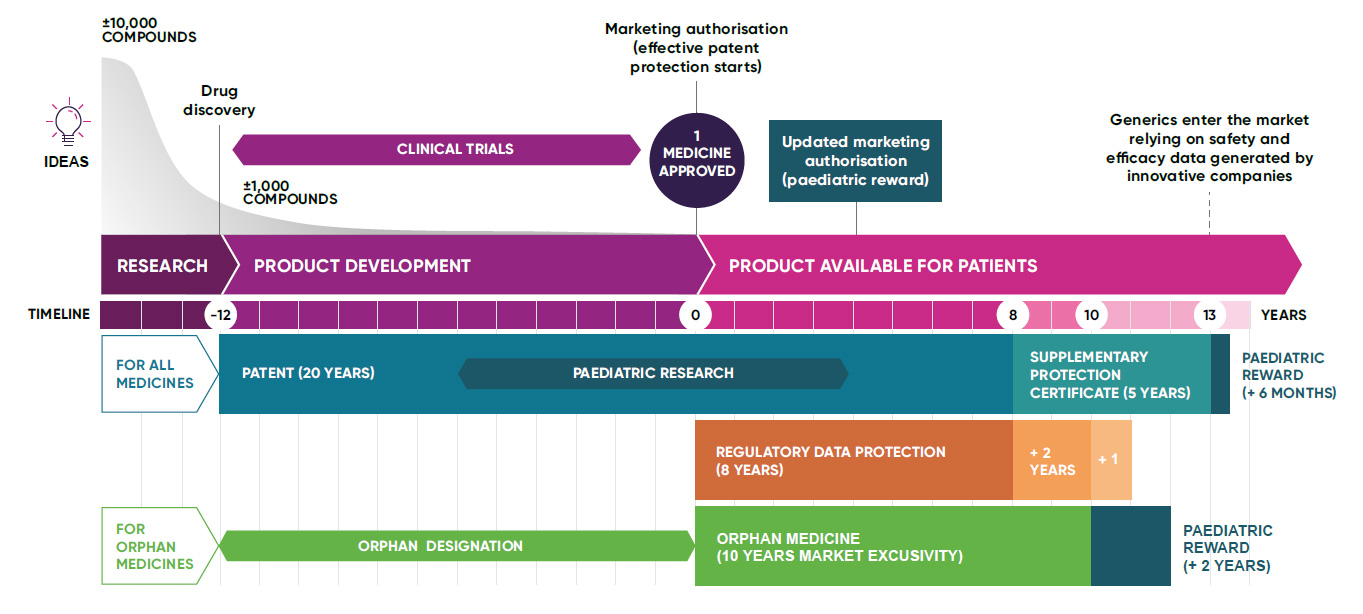

Developing medicines and vaccines is a uniquely high-risk, capital-intensive, and time-consuming process. For every 10,000 compounds that are tested, only one or two will successfully pass all stages of R&D and clinical trials to become marketable medicines.[1]

A strong intellectual property (IP) framework therefore enables the development of cutting-edge medicines and sustains future innovation. IP protection enables biopharmaceutical companies to continue investing in the high-risk process of medicines development, knowing that successful innovation will not be imitated without a period in which it can be appropriately rewarded.

The strength of the UK’s IP framework

has spurred the domestic biopharmaceutical industry to:

- invest into R&D in the UK, consistently accounting for around 20% of all industry R&D carried out between 2014 and 2020[1]

- carry out £5 billion of pharmaceutical R&D in 2020, more than any other sector of the UK economy[2]

- file over 2,500 patent applications for pharmaceutical products at the European Patent Office over the past 10 years[3]

- be one of four industries with a high IP use by UK companies in all three registered IP rights (patents, trademarks, and registered designs); 52.1% (£159.7 billion) of total UK goods export value came from industries with an above average use of at least one IP right[4]

Furthermore, the UK’s robust IP framework helps to ensure that successful innovation receives a fair return on costly medicines development, manufacturing, and commercialisation. This has helped the UK to become a major host of foreign direct investment (FDI), with the UK life sciences sector attracting £1 billion of inward investment in 2022[1]: supporting pharmaceutical manufacturing and highly skilled jobs across the UK.

The UK is classed as the fourth most innovative economy globally.[2]

COVID-19 underscored the importance of our sector in discovering, developing, and producing innovative medicines and vaccines for the future. As such, the UK biopharmaceutical industry and broader life sciences sector will be key to attracting investment in the UK’s post-pandemic era.

This will fuel the government’s efforts to grow the economy through manufacturing and job creation, and support the UK’s overall future pandemic preparedness.

Intellectual property: enabling next-generation innovation

The UK’s framework of intellectual property (IP) incentives and rewards for the life sciences fosters, protects, and promotes biopharmaceutical innovation, unlocking much-needed investment for research and development into areas of unmet medical need.

References:

[1] Drug development: the journey of a medicine from lab to shelf (The Pharmaceutical Journal, May 2015).

[2] Office for Life Sciences (OLS), ‘Life sciences competitiveness indicators 2023, Section 1: research environment’, 13 July 2023, available at: https://www.gov.uk/government/publications/life-sciences-sector-data-2023/life-sciences-competitiveness-indicators-2023#section-1-research-environment

[3] Office for National Statistics (ONS), ‘Business enterprise research and development, UK: 2020’, 19 November 2021, available at: https://www.ons.gov.uk/economy/governmentpublicsectorandtaxes/researchanddevelopmentexpenditure/bulletins/businessenterpriseresearchanddevelopment/2020

[4] European Patent Office (EPO), ‘European patent applications per field of technology and per country of residence of the applicant for each individual year from 2013 until 2022, Pharmaceuticals’, available at: https://link.epo.org/web/European_patent_applications_per_field_of_technology_per_country_of_residence_2013-2022_en_.xlsx

[5] Intellectual Property Office (IPO), ‘Use of Intellectual Property rights across UK industries: 5. IP intensive industries and the economy’, 9 June 2022, available at: https://www.gov.uk/government/publications/use-of-intellectual-property-rights-across-uk-industries/use-of-intellectual-property-rights-across-uk-industries#ip-intensive-industries-and-the-economy

[6] Office for Life Sciences (OLS), ‘Life sciences competitiveness indicators 2023, Section 5: investment environment’, 13 July 2023, available at: https://www.gov.uk/government/publications/life-sciences-sector-data-2023/life-sciences-competitiveness-indicators-2023#section-5-investment-environment

[7] World Intellectual Property Organization (WIPO), ‘Global Innovation Index 2023’, 27 September 2023, available at: https://www.wipo.int/global_innovation_index/en/2023

Related content in this section:

Last modified: 06 February 2024

Last reviewed: 06 February 2024