International and trade

Growing Britain’s life science sector through international and trade policy

In a changing international context, the UK needs an approach to international and trade policy that supports the life sciences. The sector is strategically important to the domestic economy and global health security.

The UK’s exceptional strength in life science research and production of world-class medicines and vaccines has developed over many decades out of a strong science base, open approach to foreign investment in pharmaceuticals, a skilled manufacturing workforce, and robust culture of protecting innovation through intellectual property (IP) rights. Its regulators are recognised as among the most experienced and sophisticated in the world.

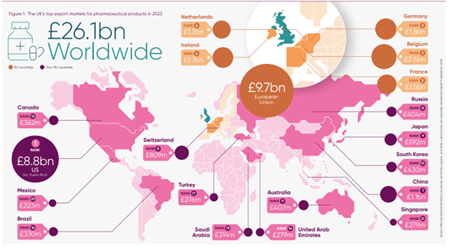

This ecosystem enables the UK pharmaceutical sector to thrive as a major exporter of life-saving medicines to patients across the globe. Over £26.1 billion worth of medicinal and pharmaceutical products were exported around the world in 20231 – the third highest goods sector in the economy, which has increased 8% in the past 5 years2.

This figure is almost double the £14 billion worth of branded medicines procured across the UK by the NHS in 20233, illustrating the scale and importance of UK pharmaceuticals trade flows compared to domestic consumption.

£25.4 billion worth of medicinal and pharmaceutical products were imported in 20233, meaning a trade surplus of £700 million in medicinal and pharmaceutical products.

Growing Britain’s life sciences sector through international and trade policy

In a changing international context, the UK needs a new approach to international and trade policy for the life sciences.

The sector is strategically important to the domestic economy and global health security and has been rightly identified by the new government as key to delivering its core missions.

The pharmaceutical industry invests £9 billion a year in UK research and development, which is by far the largest of any sector. In addition, it delivers £17.6 billion in direct gross value added (GVA)4 to the British economy and supports 126,000 high-skilled jobs across the country 5

As well as exporting vital medical goods, the UK also exports life sciences ideas – licensing treatments for production, converting its own IP into manufactured medicines in markets around the world, and shaping debates about the present and future of medicines regulation and pharmaceutical innovation.

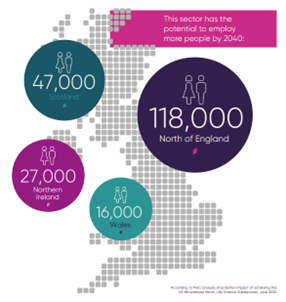

Currently, the sector employs more than 54,000 people across the North of England, for example, with the potential to employ more than 118,000 by 2040. By the same measure, we could see an additional 47,000 jobs in Scotland, 27,000 in Northern Ireland and 16,000 in Wales.

The sector also directly generates 1.25 times the economic value of the UK automotive sector and about 2.4 times that of the UK aerospace and oil and gas industries, meaning many of the jobs created by our industry will be among the most productive in Britain.

Delivering international and trade policy that supports the life sciences

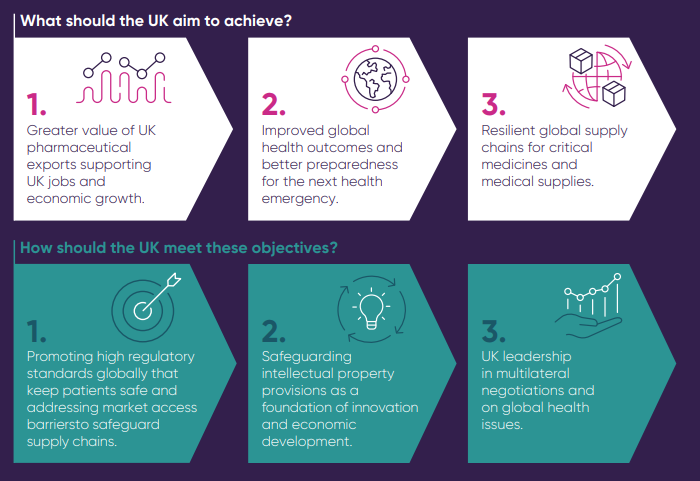

We set out three outcomes an international and trade policy should seek to support the life sciences and three pillars of activity needed to deliver them. Together, these form the basis for a clear and coherent approach to some of the biggest challenges facing both the UK and the world today, as well as significant opportunities to further bolster the UK’s competitive advantage at a time of intense change domestically and across the world.

The UK should seek to use all of the tools at its disposal to deliver on these ambitions, from high-quality Free Trade Agreements (FTAs) negotiated where there is a strong policy case to do so, to sector-specific agreements such as mutual recognition agreements (MRAs).

The role and importance of international frameworks cannot be overstated for a global sector like the life sciences. The fundamental rules of trade governed by the World Trade Organization (WTO) set minimum standards and the confidence to operate internationally as the life sciences must do, and the World Health Organization (WHO) plays an important role in global health. For the pharmaceutical industry, there are also specific international forums that set regulatory standards for health products.

The UK’s longstanding support for these frameworks is recognised by global boardrooms and vital to demonstrate how leadership can attract the investment needed to compete with the G7.

The UK should also consider more creative approaches to delivering international and trade objectives, including brokering regulatory dialogues between like-minded regulators either bilaterally or through convergence mechanisms that enable work-sharing, collaboration and resource sharing. Nor should Britain be afraid to utilise unilateral policies, such as continuing to allow medicine imports from the EU without the need to re-batch test, or reviewing its external tariff schedule, to deliver its objectives.

In all, a robust and competitive national industrial policy, together with a sophisticated international and trade policy, creates a virtuous circle that will ultimately help to deliver the growth the new government wants.

The UK should continue to influence debates for fair international treatment of Britain’s life sciences firms, while retaining a clear commitment to the strong protections at home that support the UK’s competitive advantage globally.

References:

[The following data was verified on 17 July 2024]

- Trade in Goods: Country-by-commodity exports, Office of National Statistics [Accessed 17 July 2024]

- UK trade: May 2024, Office for National Statistics [Accessed 17 July 2024]

- Aggregate net sales and payment information: February 2024, DHSC [Accessed 17 July 2024]

- Office for National Statistics, ‘Regional gross value added (balanced) by industry: all ITL regions’, 2021, available at www.ons.gov.uk/economy/grossvalueaddedgva/datasets/ nominalandrealregionalgrossvalueaddedbalancedbyindustry

- Office for National Statistics, ‘Industry census data 2021’, available at https://www.ons.gov.uk/census/census2021dictionary/variablesbytopic/ labourmarketvariablescensus2021/industrycurrent

Last modified: 27 March 2025

Last reviewed: 27 March 2025