How company payments are calculated under the 2024 VPAG

The 2024 VPAG marks a significant departure from the 2019 Voluntary Scheme (VPAS), which, with a few exceptions, essentially treated the whole branded medicines market as a single block. Under the old scheme, a single rebate rate was calculated from total sales on an annual basis.

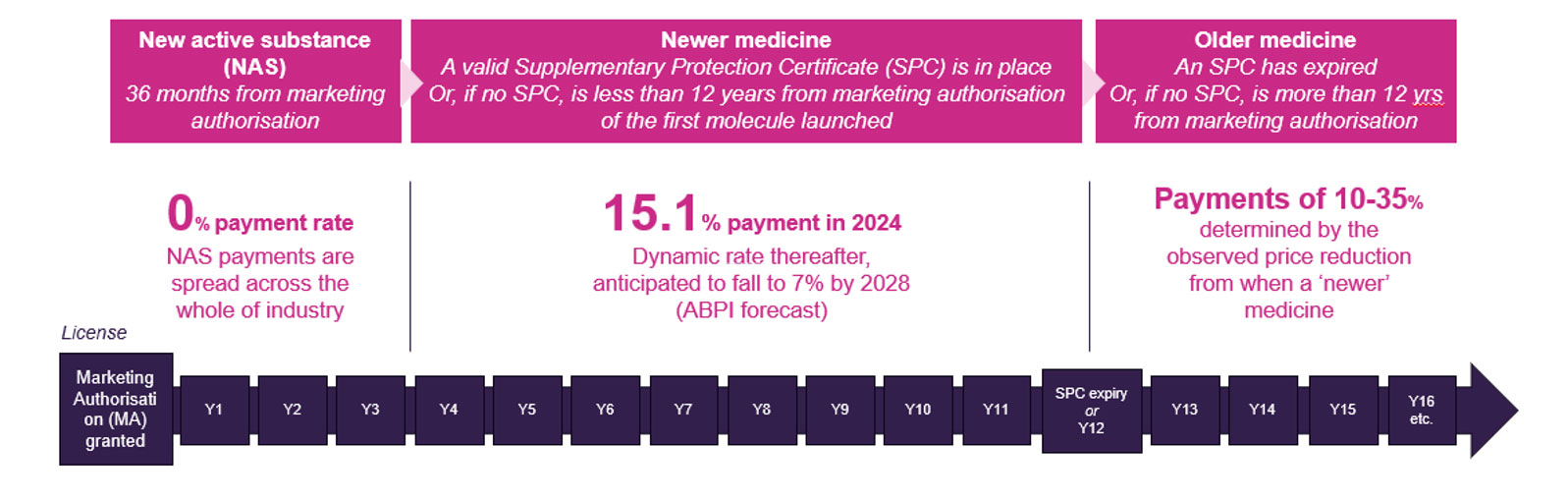

The new scheme introduces an entirely novel approach to calculating industry rebates. It uses a product-by-product assessment that classes branded medicines as either ‘New Active Substances’, ‘Newer Medicines’ or ‘Older Medicines’ based on a set of rules.

New Active Substances

New subtances defined by the first 36 months from MHRA marketing authorisation, are not subject to rebates to encourage companies to launch new treatments in the UK as soon as possible.

Small and medium-sized company exemptions

Small companies, defined as those with sales under £6 million a year, do not have to pay scheme payments. Medium-sized companies, defined those with between £6-30 million of sales a year, have their first £6 million worth of sales payment-free, and then pay VPAG payments on the rest of their sales.

New medicines

Newer medicines are generally those protected by a patent called a ‘Supplementary Protection Certificate’ (SPC) or are less than 12 years from Marketing Authorisation. However, this does not cover the full set of patents or Intellectual Property (IP) rights that exist to support innovation.

The growth in the NHS budget for newer medicines is capped, limiting what the NHS can spend on new medicines in any calendar year. However, the NHS is permitted to freely buy all the new medicines it needs, with the industry committing to return any overspending in the form of a rebate on their total sales above the budget cap.

Older medicines rebates

Older medicines are defined as those that are not ‘new’ under the scheme. The term can be misleading, as some of these products may have undergone considerable further development. Examples include changes to treat a different therapy area or part of the patient’s body, making the medicine more effective, reducing side effects, making it easier for patients to use, reducing the costs for the NHS to administer treatment (for example, turning a nurse-administered IV into a self-administered injection or tablet), or reducing the product's environmental impact.

For older medicines, rebates are calculated by assessing price changes against a historic ‘reference price’, with a price identified as close as possible to the point when the product lost its ‘UK market exclusivity’. Using a formula, companies must pay a rebate rate of between 10%-35% on their sales of each older medicine to the NHS depending on the levels of discount already offered to the NHS. This means that the NHS is guaranteed a minimum 35% reduction in the price of older medicines, whether delivered through price cuts or VPAG rebates.

There are some exemptions within this, such as plasma-derived products and low-sales products of under £1.5 million a year that pay a set 10% rebate. These have been included to support the supply viability of medicines deemed most at risk. For other medicines at risk of supply or viability issues that do not fall under these categories, companies can ask DHSC to consider ‘exceptional treatment’ in instances of global supply constraints or if a product proves uneconomic to supply However, it is not guaranteed that DHSC will grant relief to companies and these decisions are at the discretion of DHSC.

Total company rebate rates

These rules and exceptions mean that each VPAG participating company will pay a different ‘blended rate’ depending on its portfolio and the reference prices set for any older products.

The move towards a more differentiated approach across a medicine's life cycle is intended to reflect the natural pricing cycle of a medicine, acknowledging that following ‘loss of exclusivity’ (also known as patent expiry), medicines typically see further price declines from launch as generic or biosimilar competition is then allowed to enter the market.

Background to the 2024 Voluntary Scheme on Pricing, Access and Growth (VPAG)

- What is the Voluntary Scheme?

- The 2024 VPAG key objectives

- Promoting better patient outcomes and a healthier population

- Contributing to a financially sustainable NHS

- How company payments are calculated under the 2024 VPAG

- Supporting UK economic growth

Last modified: 27 March 2025

Last reviewed: 27 March 2025