UK industry clinical trial performance shows signs of improvement, says ABPI report

The decline in the number of industry clinical trials initiated in the UK shows welcome early signs of recovery. However, progress is not yet enough to restore the UK’s global ranking on trials.

The Association of the British Pharmaceutical Industry (ABPI) has published its annual report on industry clinical trial performance, ‘Getting back on track: restoring the UK’s global position in industry clinical trials.’ [1]

In the report, the ABPI welcomed ongoing efforts to address the decline in UK industry clinical trials and called for continued government focus to ensure sustainable long-term recovery in UK clinical trial performance.

The ABPI called for continued cross-government focus on speeding up clinical trial approvals and set-up, expanding UK capacity to deliver clinical trials, and improving visibility and accountability for clinical trial performance. On trial capacity, it is important to boost the workforce, facilities and infrastructure available for research.

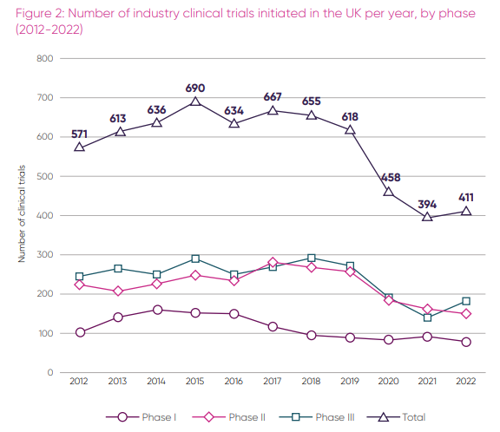

ABPI data shows that the total number of industry clinical trials initiated in the UK per year rose marginally by 4.3%, from 394 trials in 2021 to 411 in 2022, although this remains well below the 2015 peak of 690 [2].

In addition, ABPI analysis of data compiled from research organisations around the UK showed a moderate increase of 15% in annual recruitment to industry clinical trials in the UK, up by 5,366 participants year on year to a total of 42,088 in 2022/23. [3]

However, annual recruitment to industry clinical trials in the UK still remains well below the 58,048 participants recruited in 2017/18. This means there are 16,000 fewer people in the UK participating in industry clinical trials in 2022/23 than just six years ago.

The time taken to set up clinical trials also showed progress, down from an average of 305 days to an average 194 days – a reduction of 36% [4], thanks to the introduction of a model national contract called for by the ABPI, which has set out standardised costings for most trials.

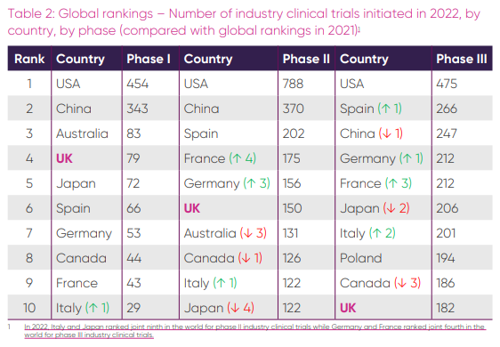

While no longer falling, the UK’s position in global clinical trial rankings remains unchanged from last year’s report. The UK came fourth for the number of phase 1 trials (79), sixth for phase two (150), and tenth for the largest and most crucial phase three trials (182), which provide the NHS with the highest income, while also providing the most patents with free cutting edge medication [5].

Janet Valentine, Executive Director of Innovation and Research Policy at the ABPI said: “We are relieved to see that the sharp decline in industry clinical trials over the past years now shows signs of recovery. But this is not a champagne cork popping moment. The UK is still ranked tenth globally as the location of choice for large commercial clinical trials, which benefit the most patients and bring income to the NHS.

“We recognise the huge amount of work by the NHS and government bodies that has gone into halting the steep decline. We are still at the beginning of a long journey.

“It’s therefore vital that the government maintains this momentum, taking further steps reversing the downward trend, to increase global confidence UK life sciences.”

The ABPI’s report recommends that the Government should prioritise existing measures from the government’s Life Sciences Vision and the recent O’Shaughnessy Review [6] of commercial clinical trials in the UK. The report outlines the measures that will make the biggest difference in the short to medium-term, so that patients can benefit quickly.

Speeding up the approval and set-up of clinical trials remains a priority, and to do this, the ABPI recommends focussing on:

- Ensuring the MHRA is appropriately resourced to maintain a high level of performance and deliver on the UK’s post-Brexit ambitions for streamlined and innovative regulation.

- Quickly expanding National Contract Value Review’s single costing review to include early-phase and Advanced Therapy Medicinal Product (ATMP) clinical trials.

Building the capacity of the NHS workforce to deliver clinical trials is another priority. For example, UK-based clinical trials companies are required to pay an additional 20% premium on top of the cost of running a trial, intended to fund capacity building. This includes things like hiring additional staff to protect research time from clinical pressures in routine care.

However, the staff responsible for delivering industry trials rarely see the financial benefits and lack visibility as to where the capacity-building charge is spent. This reduces the incentive to deliver industry trials, which in turn means that patients and the NHS miss out.

Therefore, a key area to focus on quickly is the creation of financial guidance that allows R&D departments in the NHS and its devolved equivalents to retain and reinvest revenue generated by industry trials into maintaining and building capacity.

If the recent progress on improving the clinical trials ecosystem can be maintained and the priority actions delivered, then the benefits to patients, the NHS, and the UK economy could be huge. A PwC report commissioned by the ABPI found that delivering the Life Sciences Vision could reduce the burden of disease in the UK by 40%, raise £165 million of additional revenue and £38 million of additional cost savings for the NHS in England every year, and generate £68.1 billion in additional GDP over 30 years from increased industry investment in R&D.

- Clinical research

- Trials

Last modified: 17 November 2023

Last reviewed: 17 November 2023